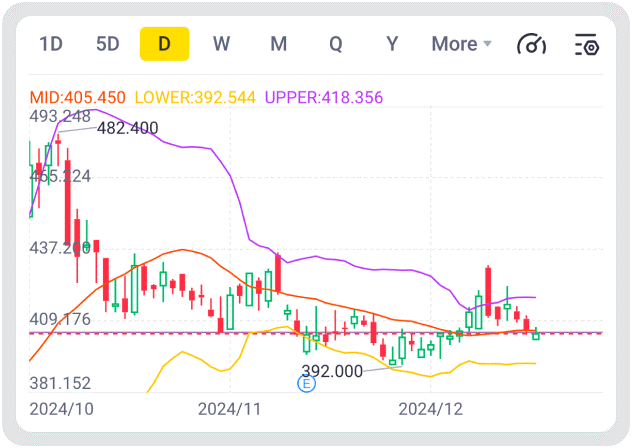

Investing in HK stocks comes with its unique set of challenges, primarily due to the potential volatility in the market. To navigate these complexities effectively, understanding the mechanisms behind order handling, especially those concerning price capping, is crucial. In this blog, we explore how Tiger Trade, developed by Tiger Brokers, addresses these challenges, enhancing the trading experience by minimizing market disruption risks while ensuring compliance with regulatory standards.

The Importance of Order Handling Controls in HK Stocks

Hong Kong’s stock market is known for its dynamism, which often brings about significant price movements. These fluctuations, while creating opportunities for profit, also introduce risks of market disruptions. Regulatory bodies, therefore, require brokers to implement stringent controls to prevent such disruptions. These controls include setting price caps and floors to manage sudden and excessive price swings effectively.

Price Caps and Floors

– Price Caps: These are upper limits set on buy orders to prevent excessively high purchase prices that could lead to abrupt market spikes.

– Price Floors: Conversely, price floors are set on sell orders to avoid overly low sales that could lead to sharp market drops.

Both mechanisms are designed to stabilize the market by preventing orders that could significantly disrupt prices. They act as safeguards keeping trading activities within a reasonable range of the current market price to ensure smoother and more predictable market movements.

Tiger Trade’s Approach to Order Handling

Tiger Trade, powered by Tiger Brokers, incorporates these regulatory requirements into its trading platform with an emphasis on optimizing order execution while safeguarding against market volatility. Here’s how Tiger Trade manages these controls:

Implementation of Price Capping

Tiger Trade integrates price capping directly into the order entry process. When traders place buy orders, the system automatically sets a maximum price limit based on current market conditions. This cap helps prevent the execution of buy orders at prices that are too high, which could otherwise lead to unanticipated market impacts.

Setting Price Floors

Similarly, when traders set up sell orders, Tiger Trade establishes a floor price. This minimum selling price helps prevent the market from experiencing sudden drops due to large sell-offs at lower-than-average prices.

Balancing Execution and Market Protection

While price caps and floors are essential for market stability, they also mean that some trades may experience delays or, in rare cases, may not execute at all if the set prices are out of sync with market conditions. Tiger Trade is designed to strike a balance, maximizing order execution rates while minimizing price risks and adhering to regulatory guidelines.

Trading HK Stocks with Tiger Brokers

For traders looking to engage with the Hong Kong stock market, Tiger Brokers offers a sophisticated yet user-friendly platform in Tiger Trade. It provides the necessary tools and features to navigate the complexities of this market:

– Real-Time Market Data: Traders receive up-to-the-minute information, allowing them to make informed decisions quickly.

– Regulatory Compliance: Tiger Trade ensures that all trading activities comply with market regulations, providing a secure and reliable trading environment.

– Educational Resources: Tiger Brokers offers extensive resources to help traders understand market dynamics, including the importance of price capping and floors.

Conclusion

Effective order handling is crucial for trading in the volatile Hong Kong stock market. With Tiger Trade, Tiger Brokers not only adheres to regulatory standards to reduce market disruption risks but also enhances the trading experience by ensuring efficient and controlled trade executions. Whether you are a novice or an experienced trader, Tiger Brokers provides the tools, support, and compliance assurance needed to navigate HK stocks confidently and successfully.